If you are doing transaction reconciliation for a Fintech, you might be dealing with the somewhat unusial challenge of multi-currency accounting. For me, the entry point was Peter Selinger’s blog post “Tutorial on multiple currency accounting“.

Other challenges:

- Large numbers of transactions

- Multiple currencies

- Multiple systems

- The finance team is looking to you to get the numbers right

- No one has a complete picture of the system

The process of a reliable reconciliation process typically involves the following steps:

- Balance reconciliation. At this step you verify that the running balance on the transaction statement for a specific bank account matches the closing balance report from that institution. This gives you the confidence to assume that all transactions have been accurately recorded.

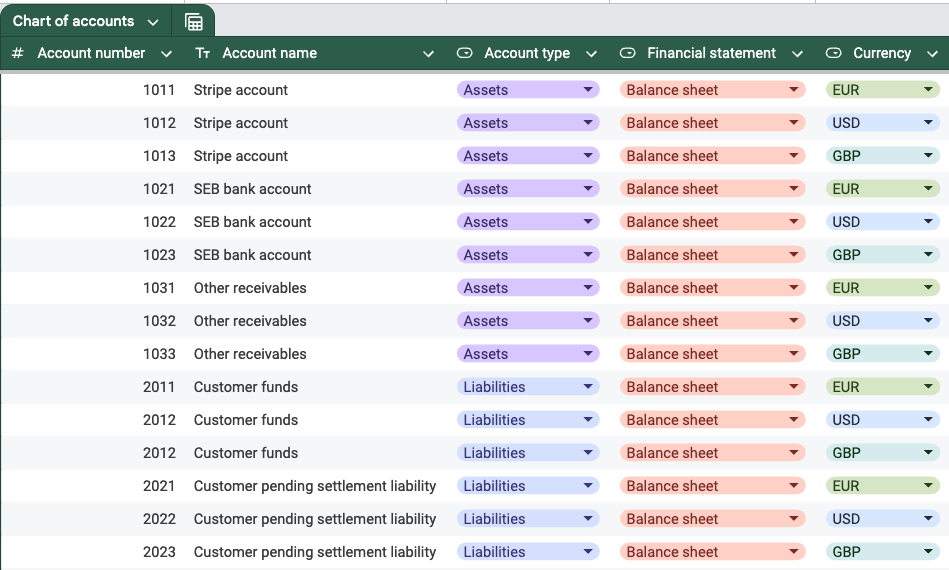

- Ledgering and accounting. We now classify each transaction based on what the purpose is. This is usually things such as payment initiation, payment settlement, currency purchases, corrections, treasury movements and revenue recognition. You need to apply accounting principles to make sure you are accurately recording assets, liabilities, revenue and costs. I created this handy spreadsheet to help you get schestarted. In reality, you are probably using some software that provides this structure for you.

- With all transactions booked appropriately, we can now ask ourselves which numbers can be reconciled against independent data points. For instance, we might verify that the amounts the treasury team has sent to a specific account matches the amounts that have arrived. We check the value of in-flight payments by comparing payment initiations to settlements

- Reporting. We can now compile our safeguarding reports, management reports, and operational reports.

Leave a Reply