Author: Erik Edin

-

Building MarTrust’s Data Team

When we set out to build a data team at MarTrust, we wanted to move from analysts working in siloes on Excel-based reports, into a single, strategic data function that drives value across the business. Today, data drives how we run quarterly planning, work with our customers and track our OKRs. Team members save on…

-

List of companies automating reconciliation

https://www.blueonionlabs.com https://kanipayments.com/ https://grath.com https://www.autorek.com/ https://getrecord.io https://www.blackline.com

-

The impact of new safeguarding rules on the UK payments industry in 2025

In September 2024, the FCA published the consultation paper CP24/20 on how they are planning to change the safeguarding regime for payments and e-money firms in 2025. We expect you to take make it a top priority to ensure that your customers’ money is safe. – FCA Dear CEO letter, 16 March 2023 The new…

-

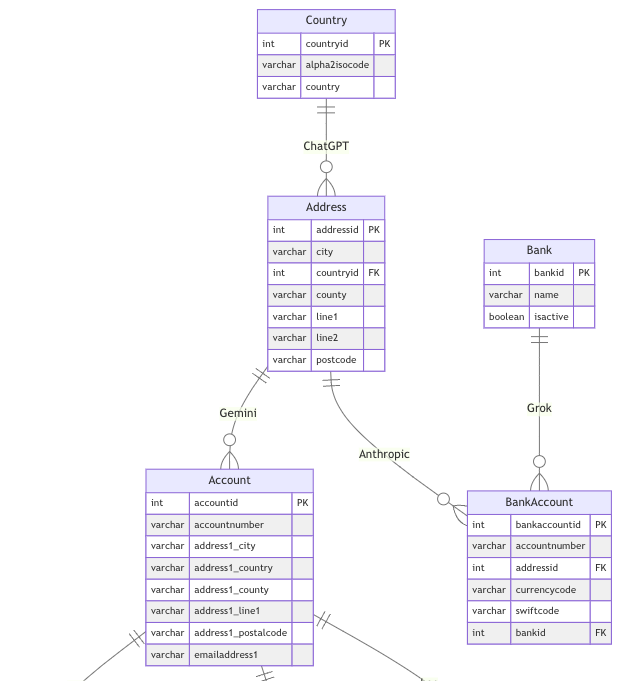

Creating a domain model diagram with AI

LLMs like ChatGPT can be a great assistant in automating foreign key discovery. Here, I walk through a Python implementation with GPT-4 that uses public datasets on BigQuery to demonstrate how it works in practice. Check out the code on Github: https://github.com/321k/FKScout. We’ll use the Overture Maps dataset, a provider of free and open map…

-

What CP24/20 means for reconciliation in the payments industry

The global payments industry has doubled in size since I organised my first event on the future of Banking in 2013, to $2.3 Trillion in annual revenue in 2023. With the growth, there has been a number of challenges, including some notable failures to safeguard customer funds. Wirecard being the most prominent one in Europe,…

-

Data team best practices in 2024

What’s considered best practices is constantly evolving, as new challenges emerge, and software change and automate the workflows of data teams. When Looker introduced a modelling layer with version control, it was a game changer for many data teams. When DBT introduced testable model generation inside data warehouses, it changed things againt. In 2024, data…

-

Multi-currency accounting for transaction reconciliation

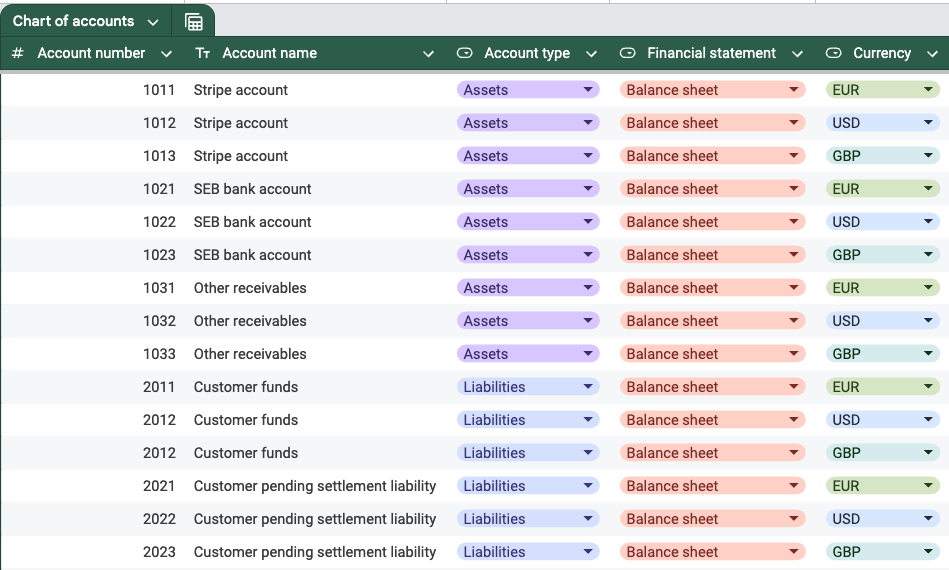

If you are doing transaction reconciliation for a Fintech, you might be dealing with the somewhat unusial challenge of multi-currency accounting. For me, the entry point was Peter Selinger’s blog post “Tutorial on multiple currency accounting“. Other challenges: The process of a reliable reconciliation process typically involves the following steps:

-

The most popular BI tools for Fintechs in 2024

A recent survey of product leaders in the Fintech Guild shows that Metabase is the most popular BI tool for Fintechs in 2024, followed by Looker, Tableau, Sigma, Omni and Mode Analytics. Metabase: Open-source and Budget-friendly With an open source code base, Metabase has been able to reach feature-parity with more established players like Looker…

-

Using AI to automate foreign key discovery

When setting up a data warehouse, understanding the relationships between various objects—both within a system and across systems—is essential. Foreign keys are the connective tissue, linking tables and datasets. When dealing with undocumented legacy systems, discovering these relationships manually can be tedious. Automated foreign key discovery, aided by AI, helps you get up to speed…